Tariff Classification: What It Is and the Different Types

In international trade, one of the most important steps is tariff classification, because this process determines the numerical code that identifies each product and sets the applicable taxes, regulations, and requirements for its import or export. Getting the classification right is crucial to avoid fines, delays, and unnecessary costs.

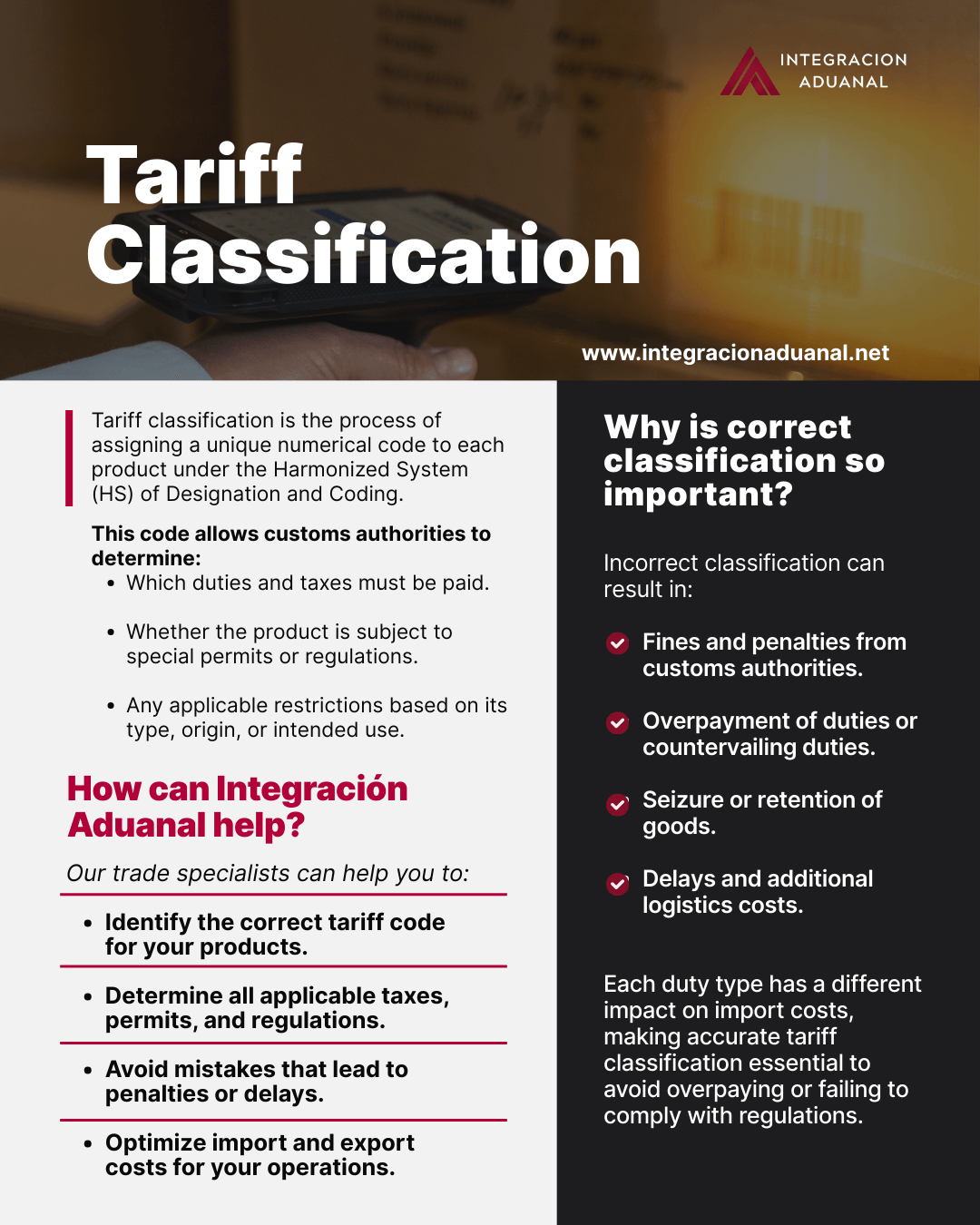

What is tariff classification?

Tariff classification is the process of assigning a unique numerical code to each product under the Harmonized Commodity Description and Coding System (HS). This code—commonly known as the tariff code—allows customs authorities to determine:

Which duties and taxes must be paid.

Whether the product is subject to special permits or regulations.

Any applicable restrictions based on its type, origin, or intended use.

In Mexico, tariff codes typically consist of 8 to 10 digits, and this can vary by country.

Types of duties

Once the correct tariff code is identified, the applicable duty type is determined. There are three main types:

Ad-Valorem Duty. Calculated as a percentage of the customs value of the product.

Example: 15% of the declared value.

Specific Duty. Charged as a fixed amount per unit of measure (weight, volume, piece, etc.).

Example: $3 USD per kilogram.

Mixed Duty. Combines an Ad-Valorem percentage with a specific amount.

Example: 10% of the customs value + $2 USD per kilogram.

Each duty type has a different impact on import costs, making accurate tariff classification essential to avoid overpaying or failing to comply with regulations.

Why is correct classification so important?

Incorrect classification can result in:

Fines and penalties from customs authorities.

Overpayment of duties or countervailing duties.

Seizure or retention of goods.

Delays and additional logistics costs.

Given the complexity of international regulations, this process requires expertise and up‑to‑date knowledge.

Infographic on tariff classification | Image created by Integración Aduanal on Canva

How can Integración Aduanal help?

At Integración Aduanal, our trade specialists help you:

Identify the correct tariff code for your products.

Determine all applicable taxes, permits, and regulations.

Avoid mistakes that lead to penalties or delays.

Optimize import and export costs for your operations.

With Integración Aduanal, you can be confident that your goods meet all requirements, helping you minimize risks and optimize costs.

Looking to import or export with complete peace of mind?

Contact us and let our experts guide you every step of the way.

References:

BBVA. (2025, 29 julio). ¿Qué son los aranceles y qué tipos existen? | BBVA México. https://www.bbva.mx/educacion-financiera/a/arancel.html#:~:text=Ejemplos%20de%20aranceles%20en%20M%C3%A9xico,por%20litro%20de%20gasolina%20importada.

@ICLawyers & By @ICLawyers. (2024, 25 febrero). Implicaciones de una incorrecta clasificación arancelaria - ICLawyers. ICLawyers. https://iclawyers.mx/implicaciones-de-una-incorrecta-clasificacion-arancelaria/

Inegi. (2021) Sistema Armonizado de Designación y Codificación de Mercancías (SA) https://www.inegi.org.mx/contenidos/app/scian/sa.pdf